We are fundamental, bottom-up investors who rely on our in-house research to make investment decisions. We assess quantitative and qualitative factors to estimate the intrinsic value of a company. Having a reasonable understanding of a company’s assets, liabilities, free cash flow, capital needs, return on capital capabilities and competitive position are important factors in assessing long-term value creation.

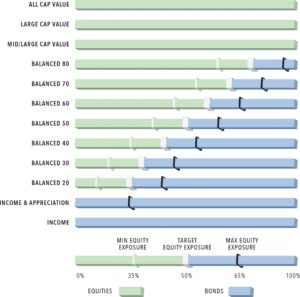

We strive to compound capital over time and to avoid needless interruption of the compounding process.